Fast Direct Payday Loans: Top Choices for Immediate Financial Alleviation

Fast Direct Payday Loans: Top Choices for Immediate Financial Alleviation

Blog Article

Straight Cash Advance Finance: Accessibility Emergency Situation Funds Without Any Credit Rating Examine - Apply Now

In times of monetary urgency, the demand for prompt access to funds without the problem of credit checks can be a crucial lifeline for several individuals. Direct payday advance loan use a swift remedy to connect the gap between restricted sources and unexpected expenditures. By bypassing standard credit report analysis processes, these lendings provide a structured course to obtaining essential funds. Nonetheless, the convenience of quick money comes with its very own set of factors to consider and ins and outs that are necessary to recognize.

Advantages of Straight Payday Advance Loan

Straight payday fundings provide quick accessibility to funds without the need for a credit score check, making them a hassle-free choice for people facing immediate monetary requirements. How to find a Direct Payday Loan. Unlike conventional car loans that may take weeks or days to procedure, straight payday lendings often provide same-day approval and down payment of funds, enabling consumers to resolve pushing monetary issues without delay.

Additionally, straight payday advance offer flexibility in regards to usage. Consumers can utilize the funds for a range of purposes, consisting of energy costs, rent out repayments, or unpredicted costs, offering a much-needed financial lifeline in times of situation. Furthermore, the absence of a credit check means that individuals with minimal or inadequate credit rating can still get approved for a straight payday advance loan, expanding access to emergency funds for a broader series of borrowers. In general, the benefits of direct cash advance make them a useful device for handling unpredicted financial challenges effectively.

How to Apply Online

When seeking to access reserve promptly and without the hassle of a credit score check, the on-line application procedure for direct payday advance uses a structured and reliable service. To obtain a direct payday advance loan online, the very first action is to discover a trustworthy lending institution that offers these services. Visit their internet site and find the online application website once you have picked a lending institution. Submit the required areas with accurate details, including individual information, work information, and financial details for funds transfer.

After submitting the application, the loan provider will review your information and make a choice concerning your car loan request. Applying for a straight payday financing online is a hassle-free way to access emergency funds without the demand for a credit rating check.

Eligibility Requirements

It is crucial for applicants to carefully examine the qualification criteria outlined by the lending institution before getting a straight cash advance finance to guarantee that they meet all requirements. Failing to satisfy these criteria can Going Here lead to the finance application being denied. By comprehending and meeting the eligibility demands, candidates can enhance their opportunities of being approved for a straight payday advance and accessing the reserve they require in a timely way.

Approval Refine Timeline

The approval process timeline for a straight payday advance loan commonly involves a number of key phases that identify the debtor's qualification and the rate at which funds can be disbursed. The preliminary action is the entry of an on-line application, which can typically be finished in an issue of minutes. When the application is obtained, the lending institution will certainly assess the borrower's information, including income confirmation and recognition checks. This phase is vital in identifying the consumer's capacity to settle the loan and makes sure compliance with laws.

Adhering to the evaluation, if the borrower satisfies the eligibility requirements, they are most likely website here to get approval promptly. Several direct payday advance loan lenders use instantaneous authorization decisions, enabling quick access to funds. As soon as authorized, the funds are usually paid out on the same day or within one service day, depending upon the loan provider's plans and the moment of application submission. Overall, the authorization procedure timeline for a direct payday advance is designed to be effective and convenient for debtors looking for emergency situation funds (Where to find a Payday Loan).

Payment Options

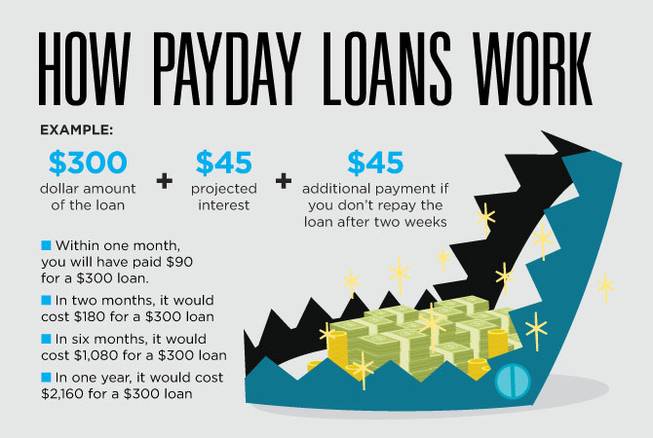

Take into consideration various repayment options readily available for direct payday advance loan to effectively handle your financial responsibilities. When it pertains to paying off a straight cash advance, borrowers normally have a few alternatives to select from. One common technique is a solitary lump-sum repayment, where the complete funding quantity plus charges is due on the debtor's next payday. This approach provides simplicity and guarantees that the financial obligation is removed swiftly.

It's important to carefully review and recognize the terms of settlement prior to concurring to a direct payday finance to guarantee you select the option that ideal fits your financial scenarios. By choosing the most ideal payment option, you can browse your economic commitments better and avoid possible pitfalls connected with payday advance loan.

Final Thought

In conclusion, straight cash advance fundings provide a convenient remedy for accessing emergency funds without the requirement for a credit report check. By following the laid out qualification needs and applying online, people can obtain quick approval and pick from various payment alternatives. This financial option gives an uncomplicated way to deal with prompt economic requirements without the trouble of typical lending processes.

Direct payday loans use fast accessibility to funds without the need for a credit report check, making them a hassle-free option for people encountering immediate economic needs. Unlike traditional fundings that may take days or weeks to process, direct payday fundings frequently offer same-day approval and deposit of funds, allowing customers to deal with pushing economic concerns without delay. The absence of a credit check suggests that individuals with poor or limited credit rating history can still qualify for a straight payday funding, broadening access to emergency funds for a broader variety of debtors - Online payday loans.When looking for to gain access to emergency funds swiftly and without the trouble of a credit report check, the online application procedure for straight payday finances provides a streamlined and effective service. Applying for a straight payday lending online is a hassle-free method to accessibility emergency situation funds without the need for a credit rating check

Report this page